Week Ending: 5th August 2011 (Week 31, Report No: 31/11)

Demolition Market:

In the demolition market, the sentiment is positive with steel prices promising high levels offered for the disposal of older units. It seems that this is the time owners to reconsider their disposal of older units and proceed with secondhand ship purchasing investments now that the asset prices are very alluring for the prospective investors.

In Pakistan, prices are still low comparing to the best levels offered by Indian scrap buyers, but there has been some increased demand and with the month of Ramadan being ahead we may see some improvement in rates and more vessels coming in the shore.

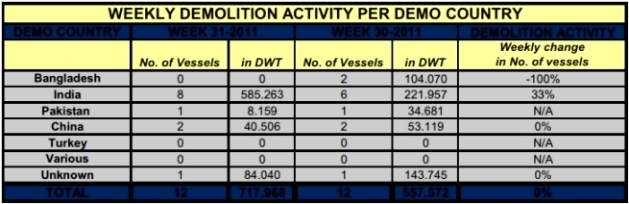

The week ended with 12 vessels reported to have been headed to the scrap yards of total deadweight 717,968 tons.

In terms of the reported number of transactions, the demolition activity has been marked with no change from previous week’s activity, while there has been a 29% increase of the total deadweight sent for scrap due to large size units sent for scrap in the bulk carriers and tanker segment.

Bulk carriers are still holding the lion’s share, 2% of this week’s total demolition activity.

In terms of scrap rates, the highest scrap rate has been achieved this week in the tanker carrier sector by India for an aframax unit of 84,040 dwt “BEL TAYLOR” of 14,830 LDT at $575/ldt incl 900 tons of IFO remaining on board.

At a similar week in 2010, demolition activity was standing at similar currently levels, in terms of the reported number of transactions, 12 vessels had been reported for scrap of total deadweight 536 mil tons with only 3 bulk carriers scrapped and India with Pakistan offering the $410/ldt for dry and $440/ldt for wet cargo.

Source: www.goldendestiny.gr

No comments:

Post a Comment