Brussels, 25 July 2018 - There were a

total of 220 ships broken in the second quarter of 2018. Of these, 169 ships

were sold to the beaches of South Asia for dirty and dangerous breaking [1].

Between April and June, 6 workers have lost their lives and 7 workers have been

severely injured when breaking ships in Chittagong, Bangladesh. Another worker

was reported dead after an accident at a shipbreaking yard in Alang, India. So

far this year, Platform sources have recorded 18 deaths and 9 injuries in South

Asia.

As

reported in our previous update, worker Shahidul Islam died at Zuma Enterprise

in April while breaking the Greek tanker EKTA, owned by Anangel Group. Belal

Hossain, Md Musa and Md Najmuddin Alazy were all mortally struck by falling

iron pieces during the cutting operations at Asadi Steel, KR Steel and S

Trading yards respectively. On 22 May, three workers got severely injured at SN

Corporation, where two other workers were killed last year. Farid Ahmed, a

cutter man from the Gaibanda region, was hit by an iron piece and killed at

Janata Steel on 31 May. One month later, 22 years old Nayon, an employee of

Kabir Steel’s Khawja shipbreaking yard, lost his life. Local sources claim that

the death of Nayon has been treated as a road accident by the yard management,

although there are no police records of such a type of accident having taken

place. In 2018, there have already been three deaths linked to Kabir Steel.

According

to local sources, three yards in which fatalities occurred this quarter - Kabir

Steel, SN Corporation and Janata Steel - are clients of Standard Chartered Bank

(SCB), although the bank neither confirmed nor denied this when asked. SN

Corporation and Kabir Steel are recurring names on the list of companies

involved in the death of shipbreaking workers. Janata Steel is the company that

bought the infamous FPSO North Sea Producer for which the Bangladesh Supreme

Court is expected to pronounce itself shortly with regards to its illegal

import. A responsible financer is expected to divest from companies that have

an extremely bad track record and continue to ignore basic health and safety

precautions for the purpose of cutting costs.

In

India, one accident in Alang, which cost the life of a worker, was reported: on

13 April, Ravindra Chaudhari, who was working in Plot 2, was hit by a falling

steel plate and died. Plot 2, which has applied to be on the EU List of

approved ship recycling facilities, and was one of the first yards in Alang to

receive a so-called Statement of Compliance with the Hong Kong Convention by

ClassNK, is the main yard of Leela Ship Recycling Pvt. Ltd. Apart from this

incident, little is known about accident records in Alang as no information is

made publically available by the authorities, and access to the yards by civil

society organisations and journalists is not allowed.

In

the second quarter of 2018, American ship owners sold the most ships to the

South Asian yards with 26 vessels beached, followed by Greek and UAE owners.

American company Tidewater was the worst corporate dumper with fifteen vessels

beached. In the end of April, Pakistan re-opened the market to the import of

tankers. In two months alone, twenty-two tankers reached the shores of Gadani

to be scrapped. Industry sources report that devaluing freight rates have

contributed to the demolition of over 100 tankers in the first half of 2018.

Only

three ships had a European flag – Greece, Malta and Norway – when they were

beached last quarter. All ships sold to the Chittagong, Alang and Gadani yards

pass via the hands of scrap-dealers, also known as cash-buyers, that often

re-register and re-flag the vessel on its final voyage. Grey- and black-listed

flags of convenience are particularly popular with cash-buyers, and more than

half of the ships sold to South Asia this quarter changed flag to the

registries of Comoros, Niue, Palau and St. Kitts and Nevis just weeks before

hitting the beach. This is the highest number of flag changes recorded by the

NGO Shipbreaking Platform and raises serious concerns with regards to the

effectiveness of legislation based on flag state jurisdiction. These flags are

not typically used during the operational life of ships and offer ‘last voyage

registration’ discounts. They are grey- and black-listed due to their poor

implementation of international maritime law.

NOTES

[1]

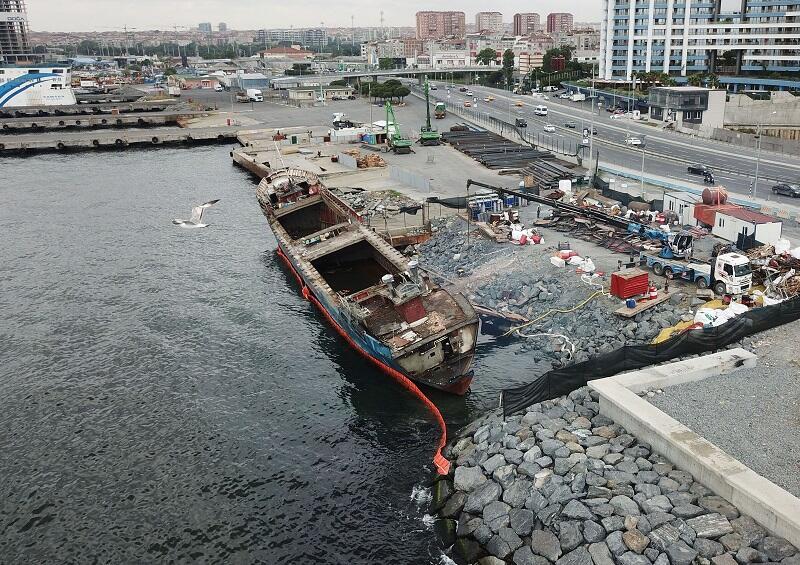

During the second quarter of 2018, the following number of vessels were broken

in other locations: 33 in Turkey, 5 in China, 4 in Europe and 9 in the rest of

the world.

CONTACT

NGO

Shipbreaking Platform

Tel.:

+32 (0) 26094419