KARACHI:

In a typical rent-seeking economy like Pakistan, it is not unusual for vested

interests to lobby against each other to extract maximum tax benefits from the

government at the cost of fair competition. And the steel industry is no

exception.

While

steel manufacturers insist that the government must revise tax rates for the

ship-breaking industry in order to ensure a level playing field for all

stakeholders, shipbreakers contend that they already operate under tight

regulatory and tax structures.

Raw

material for steel bars is obtained primarily in two forms – ship plates that

are supplied by shipbreakers, and steel billets, which are produced by steel

melters.

“The

government should impose federal excise duty on ship plates and ship items with

immediate effect at the rate of at least Rs12,000 per ton in order to ensure a

level playing field in the steel industry,” the owner of a private-sector steel

mill told The Express Tribune in a recent interview, but requested anonymity.

Currently,

the market price of steel billets is Rs81,000-82,000 per ton while ship plates

are selling at Rs67,000-68,000 per ton.

Steel

melters attribute the gap in the costs of the two products to the incentives

that the ship-breaking industry enjoys, a claim that is rejected vehemently by

the producers of ship plates.

Steel

bars are heavily used in the construction industry. Although the quality of the

steel melters’ product is markedly better than the steel bars produced from

ship plates, the fact remains that the end price of steel bars is often the

single most important factor behind total sales volumes.

Industry

experts say almost 80% of the total market of steel bars consists of the retail

segment. These retail buyers are less concerned with the quality of steel bars,

as they buy on average only five to six tons of the product for the

construction of single and double-storey houses.

In

contrast, steel bars produced from steel billets are used mostly in high-rises.

This hurts the business of steel melters, as their output is costlier by around

Rs12,000-Rs15,000 per ton.

As

per an agreement signed by the steel industry’s stakeholders in 2000, the price

difference between the two products should not be more than Rs1,200 per ton.

The agreement used customs and other kinds of duties to create equity among

different sectors of the steel industry.

However,

steel melters claim that the ship-breaking industry has received tax benefits

to the tune of Rs10 billion during the last five years in the form of

relaxation in federal excise duty and withholding tax.

“The

matter can be resolved by a policy statement and notification of a committee to

determine duties and taxes so that the difference between ship plates and steel

billets does not exceed Rs2,000 to Rs3,000 per ton at any given time,” the

steel mill owner said.

Reacting

to the demand of the imposition of federal excise duty on ship plates, Pakistan

Ship-breakers Association Chairman Dewan Rizwan Farooqui said his industry is

already paying approximately Rs1 billion every month in taxes.

“We

are a labour-intensive industry that consumes little water or electricity.

While scrap importers pay income tax at the rate of 1% only, we are subjected

to the tax rate of 5%. How else are we supposed to contribute to the national

kitty?” he said while speaking to The Express Tribune.

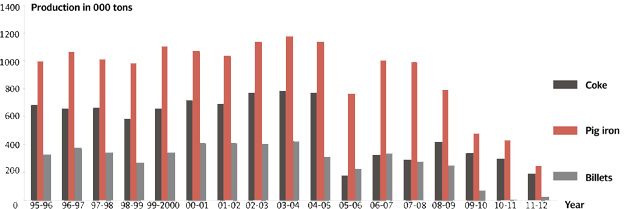

According

to Farooqui, ship-breakers produce a little less than a million tons of steel

per year while the output of steel melters is about four million tons per

annum.

However,

steel melters insist that while the share of shipbreakers used to be 20% back

in the day, the price difference has resulted in ship-breakers controlling more

than 60% of market share in recent years.

Source: The Express Tribune. 11 November 2013

No comments:

Post a Comment